According to Dong Hai

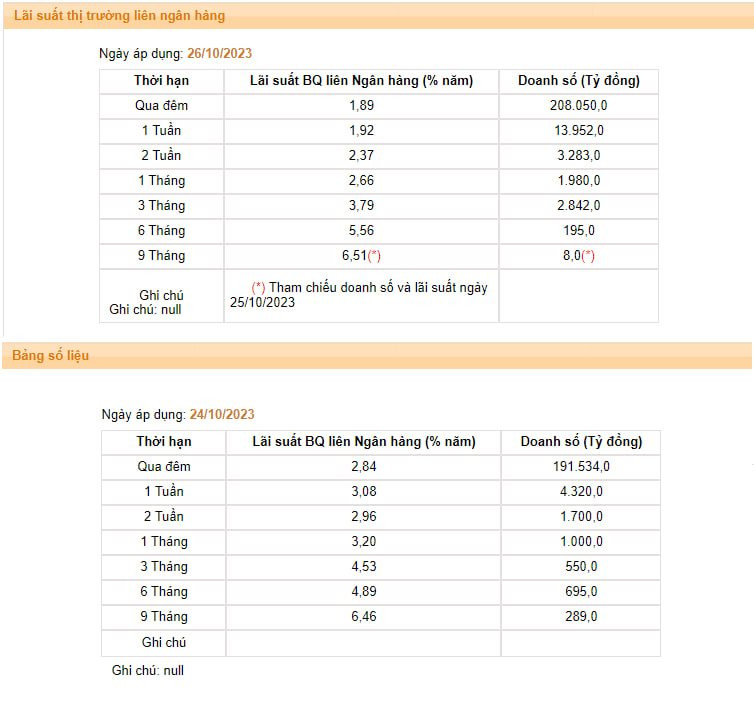

Investing.com - According to the latest data announced by the State Bank, the average interbank VND (HM:VND) interest rate at the overnight term (main term accounting for 90% of transaction value) in the October 26 session has decreased to 1.89% from 2.72% recorded in the previous session (October 25). This is the second consecutive decrease in overnight interest rates, after a sharp increase at the beginning of the week and reaching 2.82% in the October 24 session.

Although it has cooled down significantly, overnight interbank interest rates are still about 10 times higher than at the end of September and much higher than deposit interest rates for terms of less than 1 month of banks (0.1 - 0.5%/year).

Interest rates for key terms such as 1 week, 2 weeks and 1 month also decreased quite sharply compared to the first two sessions of the week.

Interbank interest rate is the loan interest rate of banks with each other through the interbank market (market 2) when banks lack cash reserves at the State Bank (each bank must maintain a required reserve ratio according to regulations).

Interbank interest rates increased sharply from historic lows, after the State Bank reopened the channel to attract money through bills from September 21. According to analysts, the SBV's move to issue bills aims to adjust liquidity in the system in the short term, and from there it is expected to push up the VND interbank interest rate level, helping to reduce the interest rate difference between USD and VND, thereby indirectly supporting the exchange rate.

The T-bill issuance activity shows a signal about the Operator's re-control of VND interbank interest rates. From there, if bad situations arise, it will be easier for the State Bank to regulate without causing "shocks" to the market, especially in the context that the Fed still leaves open the possibility of raising interest rates in the upcoming meeting. .

In the context that the USD/VND exchange rate has increased more than 4% since the beginning of the year, analysts report that the State Bank will continue to offer T-bills to maintain the interbank VND interest rate level, keeping the USD/VND interest rate difference. in a safe area. In addition, interbank interest rates are unlikely to decrease to the low level as at the beginning of the year due to a number of seasonal factors such as: credit often increases sharply at the end of the year, the warming of the real estate market or Increase public investment so that State Treasury deposits in the system will not be too abundant,...

According to Vietcombank Securities (HM:VCB), the recent issuance of treasury bills by the State Bank did not cause shocks or rapid changes to VND liquidity in the interbank system. However, in the fourth quarter, interbank interest rates are forecast to increase significantly, leaving the low level. However, due to weak credit demand, year-end liquidity shortages will be less likely to occur.

In another development, the number of winning T-bills increased sharply again in the weekend session of October 27. Specifically, the State Bank of Vietnam issued nearly 15,000 billion VND of bills, the winning interest rate decreased to 1.45% from 1.5% in the previous session.

On the contrary, there was 3,800 billion VND of treasury bills due on October 27 and the valuable paper mortgage channel continued to have no transactions. Overall, the State Bank of Vietnam net withdrew VND 11,200 billion on October 27, after 6 consecutive sessions in a net pumping state.